Director of Tax Accounting & Reporting

Before you apply to a job, select your language preference from the options available at the top right of this page.

Explore your next opportunity at a Fortune Global 500 organization. Envision innovative possibilities, experience our rewarding culture, and work with talented teams that help you become better every day. We know what it takes to lead UPS into tomorrow—people with a unique combination of skill + passion. If you have the qualities and drive to lead yourself or teams, there are roles ready to cultivate your skills and take you to the next level.

Job Description:

The Director of Tax Accounting and Reporting is responsible for the company's worldwide tax provision and financial reporting for income taxes under US GAAP. In addition, the position is responsible for meeting the company's US federal income tax compliance requirements.

Leads the quarterly and annual income tax provision process under US GAAP. Including:

- Manage the tax provision process in accordance with ASC 740, including the calculation and documentation of quarterly and annual tax provisions.

- Reviews disclosures related to income taxes in the company’s financial and regulatory filings.

- Establish and maintain effective internal controls over tax accounting processes.

- Coordinates external financial statement audit requests related to income tax.

- Supervise and review preparation of material non-US income tax provisions by outside service provider.

- Responsible for multi-year income tax accounting forecasts for profit plan including cash taxes, tax expense and tax balance sheet accounts.

- Monitors and accounts for changes in tax law and changes in accounting standards impacting income tax.

- Provide guidance on income tax implications of business initiatives, acquisitions, and other transactions.

- Manages the provision process using OneSource Tax Provision.

Leads the US Federal Income Tax Compliance processes. Including:

- Responsible for accurate US federal income tax returns.

- Approves calculation of quarterly federal estimated tax payments.

- Provides input on information requested from the tax controversy group for IRS audits.

- Manages the compliance process using OneSource Income Tax.

Identifies and implements process improvements.

Leads and develops team of tax managers and tax supervisors. Works with personnel in various departments including accounting, investor relations, treasury, real estate, benefits, and region tax related to tax provision and compliance issues.

Qualifications

- Bachelor's degree in accounting, finance, or related field; master’s degree preferred; CPA certification preferred.

- Minimum of 8 years of experience in tax accounting and reporting, with progressive leadership responsibilities.

- In-depth knowledge of US tax laws and regulations, including ASC 740 and tax compliance requirements.

- Strong analytical and problem-solving skills, with the ability to interpret complex tax issues and provide strategic recommendations.

Last Day to Apply: Friday, May 3rd at 11:59pm ET

Internal Job Grade: 40F

Hired applicants may be eligible for Medical/prescription drug coverage, Dental & Vision Benefits, Flexible Spending Account, Health SavingsAccount, Dependent Care Flexible Spending Account, Basic and Supplemental Life Insurance & Accidental Death and Dismemberment, DisabilityIncome Protection Plan, Employee Assistance Program, Educational Assistance Program, 401(k) retirement program, Vacation, Paid Holidays andPersonal time, Paid Sick/Family and Medical Leave time as required by law, Discounted Employee Stock Purchase Program.

Employee Type:

PermanentUPS is committed to providing a workplace free of discrimination, harassment, and retaliation.

Other Criteria:

Employer will sponsor visas for specific positions. UPS is an equal opportunity employer. UPS does not discriminate on the basis of race/color/religion/sex/national origin/veteran/disability/age/sexual orientation/gender identity or any other characteristic protected by law.

Basic Qualifications:

Must be a U.S. Citizen or National of the U.S., an alien lawfully admitted for permanent residence, or an alien authorized to work in the U.S. for this employer.

-

Explore UPS

Want to learn even more about UPS? Check out these additional stories about our people, mission, values and global impact.

-

-

Join UPS in Allentown, PA

Allentown is a great place to live and work! And right now, we’re looking for Warehouse Workers - Package Handlers to join our team and help us deliver what matters.

-

UPS Careers in Atlanta, GA

UPS offers opportunities all over the country—and the world! Right now, we have openings in Atlanta for Warehouse Worker - Package Handler roles.

-

Trailblazing Twin Sisters

Alyssa Strickland and Brittney Strickland-Varnedoe are identical twins and colleagues who have become an inspiration for other women in operations. Read more about the important work they’re doing as On-Road Supervisors to keep our tractor-trailer drivers safe.

-

Making Progress Toward Our DE&I Goals

Our Diversity, Equity, and Inclusion Report shows how we’re making UPS a great place to work for all. Check out the key takeaways from our 2022 report.

-

Warehouse Worker - Package Handler Roles in Boston, MA

Join us in Boston today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

UPS Careers in Charlotte, NC

UPS offers opportunities all over the country—and the world! Right now, we have openings in Charlotte for Warehouse Worker - Package Handler roles.

-

Warehouse Worker - Package Handler in Chicago, IL

Join us in Chicago today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

Warehouse Worker - Package Handler Roles in Columbus, OH

Join us in Columbus today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

Warehouse Worker - Package Handler Roles in Denver, CO

Join us in Denver today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

Join UPS in Dallas Fort Worth area!

Dallas Fort Worth area is a great place to live and work! And right now, we’re looking for Warehouse Worker - Package Handler to join our team and help us deliver what matters.

-

UPS Careers in Earth City, MO

UPS offers opportunities all over the country—and the world! Right now, we have openings in Earth City for Warehouse Worker - Package Handler.

-

Warehouse Worker - Package Handler Roles in Harrisburg, PA

Join us in Harrisburg today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

Join UPS in Indianapolis, IN

Indianapolis is a great place to live and work! And right now, we’re looking for Warehouse Workers and Package Handlers to join our team and help us deliver what matters.

-

UPS Careers in Kansas City, MO

UPS offers opportunities all over the country—and the world! Right now, we have openings in Kansas City for Warehouse Worker - Package Handler.

-

UPS Careers in Los Angeles, California

UPS offers opportunities all over the country—and the world! Right now, we have openings in Los Angeles for Warehouse Worker - Package Handler.

-

Join UPS in Louisville, KY!

Louisville, KY is a great place to live and work! And right now, we’re looking for Warehouse Workers - Package handlers to join our team and help us deliver what matters.

-

UPS Careers in Minneapolis, MN

UPS offers opportunities all over the country—and the world! Right now, we have openings in Minneapolis, MN for Warehouse Worker - Package Handler.

-

Warehouse Worker - Package Handler in Naples, FL

Join us in Naples, FL today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

UPS Careers in Nashville, TN

UPS offers opportunities all over the country—and the world! Right now, we have openings in Nashville, TN for Warehouse Worker - Package Handler.

-

Join UPS in New York, NY

New York is a great place to live and work! And right now, we’re looking for Warehouse Workers - Package Handlers to join our team and help us deliver what matters.

-

UPS Careers in Oakland, CA

UPS offers opportunities all over the country—and the world! Right now, we have openings in Oakland, CA for Warehouse Worker - Package Handler.

-

Warehouse Worker - Package Handler Roles in Philadelphia, PA!

Join us in Philadelphia, PA today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

UPS Careers in Phoenix, Arizona

Learn more about what UPS has to offer in Phoenix, Arizona.

-

Warehouse Worker - Package Handler Roles in Pittsburgh, PA

Join us in Pittsburgh today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

Join UPS in Portland, OR

Portland is a great place to live and work! And right now, we’re looking for Warehouse Workers - Package Handlers to join our team and help us deliver what matters.

-

UPS Careers in Rockford, IL

UPS offers opportunities all over the country—and the world! Right now, we have openings in Rockford for Warehouse Worker - Package Handler.

-

Warehouse Worker - Package Handler Roles in Salt Lake City, UT

Join us in Salt Lake City today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

UPS Careers in Washington, D.C.

UPS offers opportunities all over the country—and the world! Right now, we have openings in Washington D.C. for Warehouse Workers - Package Handlers.

-

Warehouse Worker - Package Handler Roles in Syracuse, NY

Join us in Syracuse today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

UPS Careers in Seattle, WA

UPS offers opportunities all over the country—and the world! Right now, we have openings in Seattle for Warehouse Worker - Package Handler.

-

Living and Working in Greenville, SC

Located 90 minutes northwest of Columbia, SC, Greenville is a small, suburban city packed with and the arts and attractions, full of UPS career opportunities and near to amazing parks, forests and more.

-

Living and Working in Phoenix, AZ

With a flourishing arts scene, rich culture and strong sports presence, whatever you’re looking for in a place to call home, Phoenix has it in abundance—and a career at UPS will help you enjoy it.

-

Living and Working in San Antonio, TX

Art galleries, theaters and museums. Botanical gardens and riverside walkways. A UNESCO World Heritage site. And great career opportunities. It’s all right here in San Antonio.

-

"This Could Be 'U'PS"

Hear from three-time intern and now full-time UPSer, Ousseynou Gueye

-

Taking On Global Challenges

In response to the ongoing refugee crisis across Europe, UPS has provided more than $7 million in support since 2012, including significant funding, in-kind and volunteer support. We have shipped supplied for food, shelter, medicine and more on behalf of many international aid organizations.

-

Life-saving drones

This is the story of how UPS shipped blood, medicine and vaccines to facilities across Rwanda using a fleet of drones.

-

The Gift of Life, Delivered

UPS is trusted to ship life-saving organs to transplant centers across the US thanks to our express critical healthcare services.

-

Rising In the Face of Disaster

This is the story of how UPS has shipped army hospitals overnight across the US, from Reno, Nevada, to New Orleans, Louisiana.

-

Giving back to those who gave so much

UPS is a long-time supporter of veterans. This is just one story of how our employees have gotten involved with initiatives that give back to those who’ve given so much to our country.

-

Spreading cheer to those who need it most

For many people around the world, the holiday season can be especially exciting. The same rings true for our hardworking UPSers, who work around the clock to make the holidays extra special. We consider it an honor and a privilege to deliver so many important packages.

-

Caring About Our Local Community

Wherever we work, we help. Wherever our employees live and customers are, we help. Wherever and whenever we can, we help. And we do it through volunteerism and providing resources.

-

Horizon Award 2021

Top performers recognized with Horizon, Special Horizon and Changemaker Awards

-

UPS Named 2021 CIO 100 Award Winner

Recognized for industry-first Harmonized Enterprise Analytics Tool (HEAT)

-

I.T. Successfully Implements Digital Access Program (DAP) Agile Release Train (ART)

Team recognized for driving improvements to critical program making it easier for small & medium businesses (SMB) to ship with UPS

-

UPS Named Top 100 Best Places to Work in I.T.

2021 listing from Insider PRO and Computerworld based on survey of our I.T. Team members and offerings including benefits, career development, training and career development

-

In safe hands

With the help of UPSers like Assistant Chief Pilot, Alyse Adkins, we were able to ship vaccines to more than 110 countries with a 99.9% on-time delivery rate.

-

What Do You Do for a Living?

UPS driver answers social media star’s famous question

-

UPS Careers in Madison, WI

UPS offers opportunities all over the country—and the world! Right now, we have openings in Madison for Warehouse Worker - Package Handler.

-

UPS Careers in Ontario, California

UPS offers opportunities all over the country—and the world! Right now, we have openings in Ontario for Warehouse Worker - Package Handler.

-

UPS Careers at SMART in Atlanta, GA

UPS offers opportunities all over the country-- and the world! Right now, we have openings at the SMART Hub in Atlanta for Warehouse Worker- Package Handler roles.

-

At UPS, we’re serious about safety

This year we’re welcoming more than 1,600 building mechanics and porters from around the world into the inaugural class of Safe Work Heroes. These UPSers have all worked at least five years injury-free and now proudly wear a patch showing off that honor.

-

UPS named 2022 CIO 100 award winner

UPS has been named a 2022 CIO 100 award winner by Foundry’s CIO for Address Analytics Application (AAA), a system which manages nearly 375 million addresses globally to provide a world-class customer experience, reduce cost to serve and generate millions in revenue recovery.

-

UPS named Overall Best in Future Intelligence winner

International Data Corporation (IDC) announced that UPS was named Overall Best in Future of Intelligence Winner in its inaugural IDC Future Enterprise Best in Future of Intelligence North America Awards for Anticipated Delivery and Package Time (ADAPT).

-

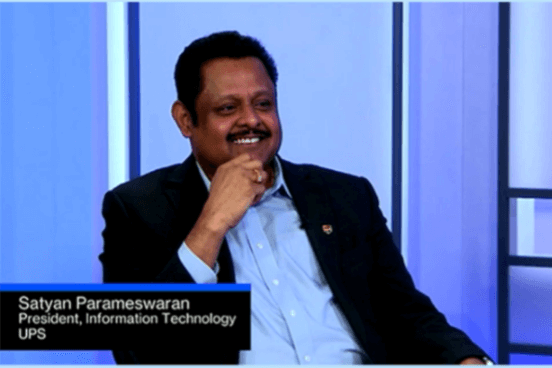

UPS I.T. speaks with Bloomberg

Satyan Parameswaran, Vice President, UPS Information Technology (I.T.), Operations Technology (OPT), sat down with Lisa Abramowicz of Bloomberg TV to discuss intelligent automation and its effects on the UPS enterprise.

-

I.T. University- A chance to learn and grow

I.T. University gives UPSers a platform to continue to grow and learn amongst like-minded colleagues, where they can link their personal and career development.

-

Plein feux sur nos sUPerS employés

Laissez-nous vous présenter quelques-unes des personnes qui font une réelle différence ici chez UPS. Sans elles, nous ne serions pas en mesure de réussir !

-

UPSer Spotlight

Let us introduce you to some people making a real difference here at UPS—we wouldn’t be able to do this without them!

-

Meet Our Team

See the people and places that make it possible for UPS to deliver what matters in communities across the country.

-

Getting to Know UPS

Who are we? Why do we love what we do? Get answers directly from UPSers on some of your biggest questions.

-

Getting to Know UPS

Who are we? Why do we love what we do? Get answers directly from UPSers on some of your biggest questions.

-

UPSer Spotlight

Let us introduce you to some people making a real difference here at UPS—we wouldn’t be able to do this without them!

-

Rencontrez notre équipe

Découvrez les personnes et les endroits qui permettent à UPS de livrer ce qui compte dans les communautés partout au pays.

-

Rencontrez notre équipe

Découvrez les personnes et les endroits qui permettent à UPS de livrer ce qui compte dans les communautés partout au pays.

-

Apprendre à connaître UPS

Qui sommes nous? Pourquoi aimons-nous ce que nous faisons ? Obtenez des réponses directement de nos sUPerS employés sur certaines de vos plus grandes questions.

-

UPSer Spotlight

Let us introduce you to some people making a real difference here at UPS—we wouldn’t be able to do this without them!

-

Plein feux sur nos sUPerS employés

Laissez-nous vous présenter quelques-unes des personnes qui font une réelle différence ici chez UPS. Sans elles, nous ne serions pas en mesure de réussir !

-

Apprendre à connaître UPS

Qui sommes nous? Pourquoi aimons-nous ce que nous faisons ? Obtenez des réponses directement de nos sUPerS employés sur certaines de vos plus grandes questions.

-

Meet Our Team

See the people and places that make it possible for UPS to deliver what matters in communities across the country.

-

UPSer Spotlight

Let us introduce you to some people making a real difference here at UPS—we wouldn’t be able to do this without them!

-

Getting to Know UPS

Who are we? Why do we love what we do? Get answers directly from UPSers on some of your biggest questions.

-

Getting to Know UPS

Who are we? Why do we love what we do? Get answers directly from UPSers on some of your biggest questions.

-

Meet Our Team

See the people and places that make it possible for UPS to deliver what matters in communities across the country.

-

Meet Our Team

See the people and places that make it possible for UPS to deliver what matters in communities across the country.

-

Meet Our Team

See the people and places that make it possible for UPS to deliver what matters in communities across the country.

-

UPSer Spotlight

Let us introduce you to some people making a real difference here at UPS—we wouldn’t be able to do this without them!

-

Getting to Know UPS

Who are we? Why do we love what we do? Get answers directly from UPSers on some of your biggest questions.

-

Meet Our Team

See the people and places that make it possible for UPS to deliver what matters in communities across the country.

-

Meet Our Team

See the people and places that make it possible for UPS to deliver what matters in communities across the country.

-

UPSer Spotlight

Let us introduce you to some people making a real difference here at UPS—we wouldn’t be able to do this without them!

-

UPSer Spotlight

Let us introduce you to some people making a real difference here at UPS—we wouldn’t be able to do this without them!

-

Getting to Know UPS

Who are we? Why do we love what we do? Get answers directly from UPSers on some of your biggest questions.

-

Meet Our Team

See the people and places that make it possible for UPS to deliver what matters in communities across the country.

-

Getting to Know UPS

Who are we? Why do we love what we do? Get answers directly from UPSers on some of your biggest questions.

-

UPSer Spotlight

Let us introduce you to some people making a real difference here at UPS—we wouldn’t be able to do this without them!

-

Carina Calugcug

"I like that our growth can be lateral or vertical - it's our call. I get to decide how I want to grow and what I want to experience."

-

Sherry Sun

"My career here, 20 years and counting, is a story of progress and moving forward."

-

Meet Our Team

"I'm proud to know that we connect the world and that, here, we can be who we are. Even with a dress code, we can express ourselves."

-

UPSer Spotlight

“Here at UPS we have daily challenges and opportunities for growth with the company. What I like here is that we can always improve. I can be who I am - in and out of UPS.”

-

Meet Our Team

“Delivering what matters is what makes me happy. Bringing Covid's vaccine to Brazil made me very proud, knowing that I participated in this moment confirms that we do deliver what matters.”

-

UPSer Spotlight

“I can say that I felt in love of being an UPSer! Here we help societies and companies to grow, we help to open doors by delivering different logistic solutions and we grow together.”

-

Meet Our Team

“At UPS you are able to change and develop not only your professional skill but also your personal ones.”

-

Getting to Know UPS

“Some people think that we delivery packages but is more than that, here we deliver dreams, gifts, memories.”

-

-

Meet Our Team

By working with UPS as an intern, Kevin was able to apply his classroom knowledge in a real-world setting. Through the process, he also realized how much tech it takes to keep our operations running successfully.

-

UPSer Spotlight

Sheneda was impressed to see all the technology behind UPS during her time with us. As a computer science intern, she found mentorship while getting hands-on experience with different programming languages.

-

UPSer Spotlight

Nicole had the unique chance to work on not one but two projects in her time at UPS. The intern experience allowed her to grow a multitude of skillsets and feel integrated in the welcoming culture here.

-

Meet Our Team

Being a UPS IT intern meant that Bavitha got to see firsthand all of the cutting-edge tech we use—like robots and AI. The hands-on experience and positive culture helped her grow personally and professionally.

-

Meet Our Team

As a quantitative economics and econometrics major, Ryan was eager to put his skills to use at UPS. His internship here gave him the opportunity to work with large data sets using programs like Python and Looker.

-

Opportunities at UPS

Discover how UPS delivers what matters to our customers and our people year-round. Fantastic pay and benefits, cutting-edge technology and opportunities for advancement are just a few of the reasons why you belong at UPS.

-

Connecting Servers to Optimize UPS’s Customer Support

Sheneda was impressed to see all the technology behind UPS during her time with us. As a computer science intern, she found mentorship while getting hands-on experience with different programming languages.

-

Taking Data Storage and Visualization to New Heights at UPS

As a quantitative economics and econometrics major, Ryan was eager to put his skills to use at UPS. His internship here gave him the opportunity to work with large data sets using programs like Python and Looker.

-

Creating Efficiencies Within UPS Through File and Systems Automation

Nicole had the unique chance to work on not one but two projects in her time at UPS. The intern experience allowed her to grow a multitude of skillsets and feel integrated in the welcoming culture here.

-

Growing a Deeper Understanding of Computer Science at UPS

By working with UPS as an intern, Kevin was able to apply his classroom knowledge in a real-world setting. Through the process, he also realized how much tech it takes to keep our operations running successfully.

-

Optimizing Electrical and Mechanical Engineering in UPS Facilities

During her time with UPS, Jaidaa learned that she can make a real difference in our daily operations—even as an intern. Plus, she was able to learn more about different areas of engineering along the way.

-

Join UPS in Mebane, NC

Join us in Mebane, NC today to begin a rewarding career as a Part Time Supervisor. Read on to discover more about the work, location and benefits.

-

Itz-El Martinez Osnaya

“En UPS puedes cambiar y desarrollar no sólo tus habilidades profesionales sino también las personales.”

-

Carlos Ruiz Perez

“¡Puedo decir que me he enamorado de ser un upser! Aquí ayudamos a las sociedades y a las empresas a crecer, ayudamos a abrir puertas entregando diferentes soluciones logísticas y crecemos juntos.”

-

Anlly Montoya

“Estoy orgullosa de saber que conectamos el mundo y que acá, podemos expresarnos como realmente somos.”

-

Jairo Ramirez

“Aquí en ups tenemos retos diarios y oportunidades de crecimiento con la empresa. Lo que me gusta aquí es que siempre podemos mejorar. Puedo ser quien soy, dentro y fuera de UPS.”

-

UPS is Named a 2023 Top Company by LinkedIn

Based on in-depth research and data, LinkedIn’s Top Companies list recognizes workplaces that are invested in their employees’ development and well-being.

-

Join UPS in North Baltimore, Ohio

Join us in North Baltimore, OH today to begin a rewarding career as a Part Time Supervisor. Read on to discover more about the work, location and benefits.

-

Join UPS in Bayonne, NJ

Bayonne, NJ is a great place to live and work! And right now, we’re looking for Warehouse Workers to join our team and help us deliver what matters.

-

UPSer Spotlight

Donovan shares how the Metropolitan College Program allowed him to use his classroom knowledge to advance his career with UPS.

-

Setting Students up for Success

Because of the Metropolitan College Program, Jordan was able to follow her creative passions while securing her financial future.

-

UPSer Spotlight

Katy shares how our Metropolitan College Program offers the best of two worlds: a dynamic, fast-paced job and a classic campus experience!

-

Expand Your Skillset and Advance Your Career

By earning her degree while working at UPS Worldport, Shawna not only saved money, but she also learned the work ethic and time management skills that helped her achieve amazing professional growth.

-

UPS Worldport

Get to know more about the biggest UPS hub in the world—also known as UPS Worldport—located right here in Louisville!

-

Warehouse Workers - Package Handlers in Middletown, PA

Join us in Middletown today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

-

Puestos por hora

Ayudarás a entregar lo que importa. Ofrecemos puestos por hora de tiempo completo, medio tiempo, durante todo el año y por temporada.

-

Conheça o time UPS

"Entregar o que importa é o que me faz feliz". Trazer a vacina da COVID para o Brasil me deixou muito orgulhoso, saber que participei deste momento confirma que entregamos o que importa."

-

Proceso de postulación e incorporación

Nuestro proceso de contratación en línea es rápido: para algunos puestos no tienes que asistir a una entrevista, y puedes recibir una oferta de trabajo en un plazo de 20 minutos.

-

Laura Ramirez

“Algunos piensan que entregamos paquetes pero es más que eso, aquí entregamos sueños, regalos, recuerdos, aprendemos cada día, ups nos da la oportunidad de crecer y desarrollarnos.”

-

Getting to Know UPS

Zane is a DE&I Intern revamping UPS’s Legacy of Diversity Catalog. He has been making the most of all the opportunities UPS has to offer, working in different departments and building his professional network.

-

UPSer Spotlight

Leah is an Intern in our Finance & Accounting department. She likes working at UPS because we are a customer-focused company that gives back to the community and works to protect the environment.

-

-

UPSer Spotlight

Sales and Solutions Intern Ariel chose UPS because we invest in our Interns, providing them with impactful work that can prepare them for a full-time role.

-

Meet the Team

Muhammed is an Information Technology Intern who was drawn to UPS because of our strong brand identity and endless opportunities.

-

Getting to Know UPS

As an Engineering Intern, Evan is optimizing driver routes and building his professional network by getting to know his fellow UPSers.

-

Meet the Team

As an FP&A (Finance Procurement & Analysis) Intern, Jake appreciates how UPS provides meaningful work that positively impacts the business, as well as our “open-door policy” that fosters a collaborative environment.

-

Getting to Know UPS

As an HR Intern, Anthony (Tony) Victorino is involved with the Talent Acquisition Veteran Initiative. In his work, he’s learned a lot about military culture and how it can translate to the workplace.

-

UPSer Spotlight

As a People & Culture HR Intern, Keola is supporting the redesign of our EVP (Employee Value Proposition). Her advice to prospective Interns? Reach out to at least five UPSers every week to learn more about what they do.

-

UPSer Spotlight

Working on the HR team allowed Sydnee to learn in a professional environment. By being agile and accepting new challenges, she’s gained valuable insight into what she wants in a future career.

-

UPSer Spotlight

As a Supply Chain Management student at Howard University and an Industrial Engineering Intern at UPS, Christian is expanding his classroom knowledge through hands-on experience.

-

Raven Morin

Meet Raven, an Industrial Engineering Intern at our Roswell facility. “The meat and potatoes of UPS is delivering packages,” she says, “so it’s cool to see how UPS makes all of this happen internally.”

-

UPSer Spotlight

Daniel is a Procurement Analytics Intern, and values getting to work with developing technologies like cloud data platforms. He also enjoys the camaraderie on his team.

-

Meet the Team

Katie is a Procurement Intern, supporting our Air Procurement Team. She values that her day-to-day work is meaningful for the company, and that our workplace culture has been friendly and welcoming.

-

Meet the Team

As an intern on our Recruitment Marketing team, Lauren got hands-on experience with almost every project. Learn more about how she felt supported by fellow UPSers during her time with us.

-

Meet the Team

Lillian is an Intern at UPS Capital, where she creates new trainings and keeps our current ones up to date. She was drawn to UPS because of the people and enjoys working on a supportive team that encourages her to introduce new ideas.

-

UPSer Spotlight

For Savannah, the chance to earn her degree while advancing her career has opened a world of possibilities for her future.